Screenshot 2022-11-15 at 14-05-50 Twitter Publish.png

Screenshot 2022-11-15 at 14-05-50 Twitter Publish.png

The upcoming cryptocurrency war

The second war on cryptography is not going to be like the first one. This time, it's not just private communications at stake — pardon the pun — but rather the foundation of sound economies itself.

Ethereum 2.0 is here; the Merge is completed — and all stakers who made it possible are now handcuffed away from their wealth.

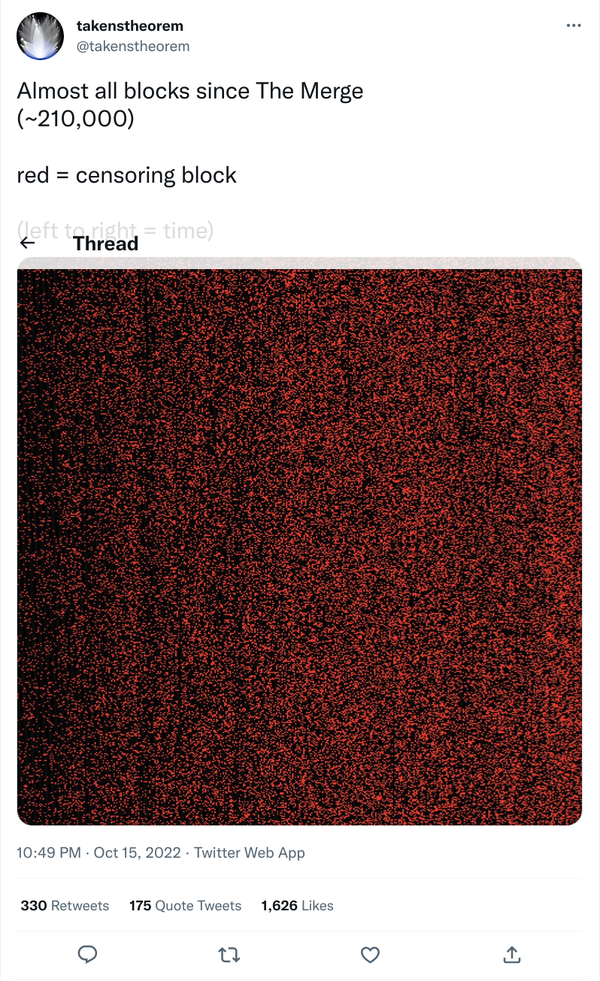

Almost immediately after the Merge took place, pretty much every block minted by the Ethereum network became OFAC-compliant — in layman's terms, they will not validate any block that might contain transactions prohibited by OFAC; any tornado.cash transactions and users are now effectively left in limbo. This reality reliably signals at least eager subservience to the United States government on the part of Ethereum validators — exactly the scenario that Bitcoin maxis predicted with the increasing (and now total) centralization of Ethereum security production in the hands of a few entities easily pushed around by governments. It's the final transition between a highly centralized network which at least pretended to be "open and permissionless", and now is 100% censored at the behest of third parties.

Here is a question that few are already pondering, relevant to the current FTX events, to which we might see an answer soon:

Will the subservient validators reverse Ethereum transactions as ordered by U.S. judges?

Hm.

If I were to bet on this, yes, I think they will reverse any transactions they are ordered to. Not only does the Ethereum network have a history of doing so — automatically making any "we can't do it" defense not credible — clearly the people actually running the Ethereum network feel strongly about obeying U.S. government orders. They are already compliant with other U.S. judge orders (namely orders registered in the OFAC shitlist). What's the problem with one more stripe on the zebra? In other words: the Ethereum network will become an agent / an accomplice of the U.S. government in enforcing its global financial repression policy.

Why might that propensity to obey orders be? Let's consider a meta-level hypothesis for a moment.

Perhaps the Ethereum people already know that the U.S. government will, sooner rather than later, attempt total war on free-as-in-freedom cryptocurrencies (likely using the current FTX-related events as one of the main pretexts). There are three fundamental ways that a State can torpedo cryptocurrencies: (1) to impose losses on holders, (2) to encourage instability in their ecosystems, (3) and to regulate / prosecute them into an inferior position with fiat currency. Total war means all three of these red buttons will be frantically pushed by the U.S. government.

I am going to make the educated guess that the stakeholders in Ethereum have made a calculated bet based on this potential future.

Their bet? In a nutshell, defection from cypherpunk principles will make them "safe" from the bully in the room.

They likely think (haha) that complying with the U.S. government (and the WEF World Order) will cull favor from the U.S. government, keeping them safe from punishment — while simultaneously ensuring the annihilation of Bitcoin (and other decentralized, permissionless, irreversible currencies) which, by design, cannot be pushed around by a government. Such a scenario would certainly be very lucrative for all the Ethereum stakeholders, and extremely destructive to the whole of the Bitcoin ecosystem; Ethereans would finally get their long-awaited Flippening!

I can tell you for sure what I think will happen: in the unlikely event that Bitcoin does go down in such a war, there is zero chance that Ethereum is going to be left standing. In fact, if Bitcoin is to go down, Ethereum will bite the dust first.

Why?

First, because people who think the above haven't modeled the U.S. government correctly — perhaps they just can't model bullies correctly, or they mistake the bully for a friend. Either way, they forget that complying with the bully doesn't placate the bully at all. Fools don't win wars!

Second: because Ethereum today solves no problem that isn't already solved by the centralized structures of governments and banks today

In a world where Ethereum is not permissionless — that is, today's world — Ethereum cannot fulfill its primary raison d'etre: permissionless secure trustworthy computation. Ethereum already doesn't deliver on its revolutionary promise; it makes a crappy substitute for existing institutions too; any regulation is going to make it (even) harder (than it already is) for Ethereum-powered products and services to substitute anything about the existing order. As for security, Ethereum 2.0's model is a banal regression to the insecure "trust the big guys" model of yore which Bitcoin made obsolete. Outside the fundamental reason why Ethereum was invented, what problem does Ethereum solve— except perhaps the "problem" of enabling unbridled fraud schemes like FTT and Luna?

Bitcoin, on the other hand, solves two problem that the Ethereum of today clearly won't; the first is permissionless private money, across borders, with low friction and high speed; the second is unprecedented protection against inflation due to its immutable rules. Granted, those two problems are exactly the problems governments don't want solved, and so far governments have been very keen on making these problems difficult to solve with Bitcoin, short of actually jailing every Bitcoin holder. However, there is always going to be a market for these solutions — white, gray or black — and therefore there is always going to be someone solving them. Bitcoin also does not enable the creation and computation of fraudulent schemes like FTT; at most, Bitcoin does enable transfers of stolen funds, but that is not a defect singular to Bitcoin — it's an attribute of any property that can be conveyed, like cash or gold.

In short: I think Ethereum will pay the cost of reneging on the fundamental principles that brought it about to begin with. Such is the wages of betrayal.

What do you, dear reader, think the outcome of this war will be? Let us know what you think in the comments for this post.

Screenshot 2022-11-15 at 14-05-50 Twitter Publish.png

Screenshot 2022-11-15 at 14-05-50 Twitter Publish.png

Screenshot 2022-11-15 at 14-09-47 takenstheorem on Twitter.png

Screenshot 2022-11-15 at 14-09-47 takenstheorem on Twitter.png

image.png

image.png

![Michael Saylor explains: "all other forms of property can be impaired, confiscated, inflated away [...] if I hold a gun to your head 'gimme your Bitcoin', you can say no — I can still shoot you, but I don't get the property. This is the only asset in the history of Mankind that you can take with you to the grave."](https://rudd-o.com/archives/the-one-feature-unique-to-bitcoin-among-all-assets-in-history/@@images/image/thumb)