image.png

image.png

The economic future of Bitcoin

The likely scenario is the undoing of 1971, as the next years come up. This article does not contain ideas that are novel — at least for HODLers — but it does explain what a Bitcoin-indexed future looks like.

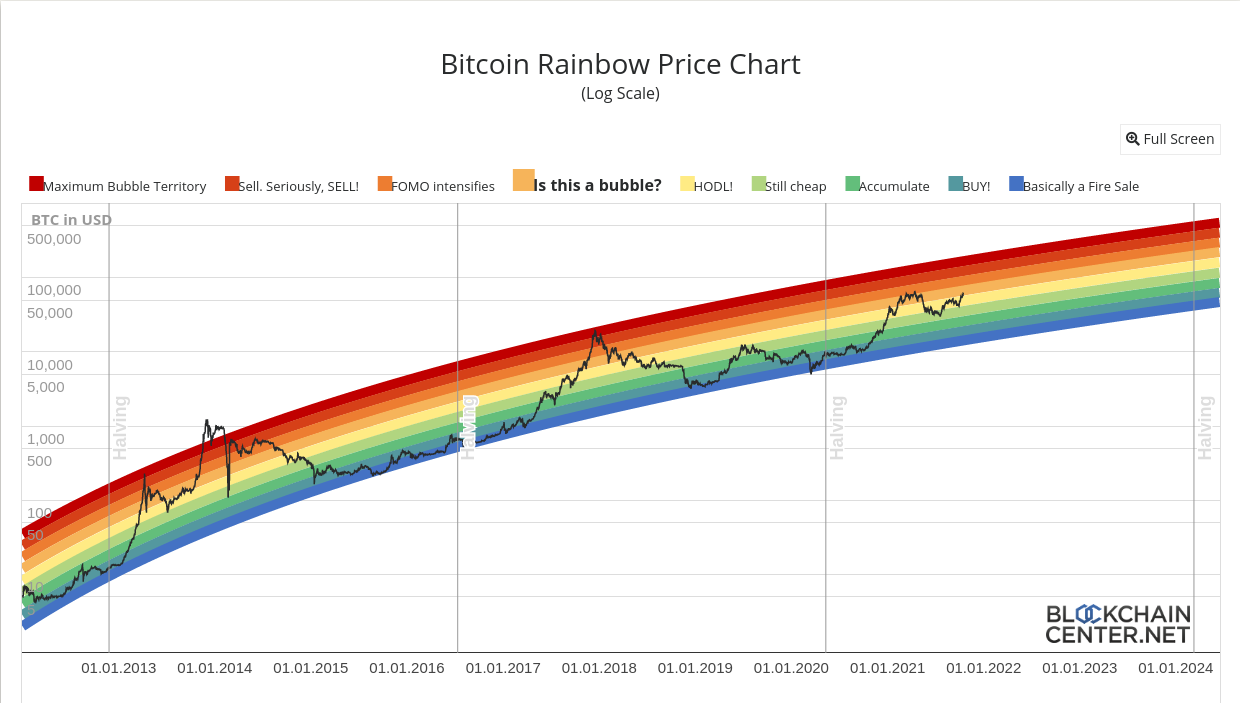

I want you to pay close attention to one phenomenon obvious from the chart. Each seasonal peak reaches less and less into the red zones.

My hypothesis for this decrease of the acceleration of the price is this: as the size of the Bitcoin market cap has grown, there will be comparatively fewer other "wealth and savings" assets that Bitcoin can effectively substitute. With an example: whereas it was really easy at the beginning for Bitcoin to act as a substitute for the first 1% all gold / T-bill purchases, the last 1% of those purchases will be very, very hard to substitute (after all, even as a maxi, I'd ask why would you want your savings to be 99% into Bitcoin?).

This does mean that the advantage of early HODLing (you know, dear HODLer, those 100X returns) would be gone. But there would still be an advantage to HODLing, and that advantage would never, ever go away. I'll explain this now.

As this hypothetical future comes closer to us, the Bitcoin price will continue to increase at a rate dictated only by the following factors:

- (+)

- the monetary inflation of the currency the price is denominated in

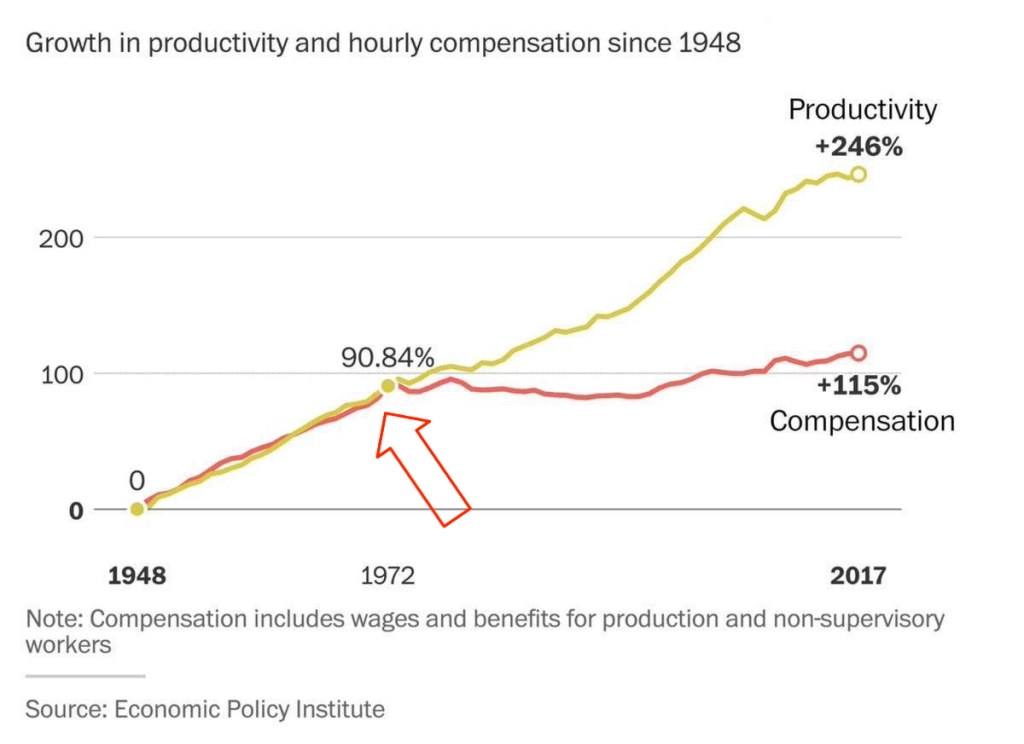

- the aggregate increase in size of the economy due to productivity increases

- (–)

- the increase in Bitcoin supply

If we strip the monetary inflation out of that equation, then what remains is (1) the Bitcoin supply increase (which will reach a near-zero epsilon in the coming decades), and (2) the increases in economic productivity.

At this point the purchasing power a Bitcoin HODLer has becomes — in a macro sense — a concrete slice of the pie that is the global economy's purchasing power. Importantly, this would be true irrespective of whether you're operating with local currencies or Bitcoin as daily payment forms.

Think about it for a second — this would be a complete reversal of the global order we have today.

- Today, if you're living in a "lucky place", the pizza you ordered "inflates in price" at a rate of, say, 3% annually, even though it gets cheaper every year to make that pizza (both in terms of labor and ingredients). Meanwhile, your salary grows — maybe — at a rate of 2-3%, and sometimes it crashes to zero for long periods of time.

- In this potential future, your salary would maintain itself (assuming you do the exact same job forever), but you'd see very clearly how every year you can afford to buy more, and more, and more, with the effects of this eternal price deflation compounding over the decades in your lifetime. Pizzas would become cheaper and cheaper (um, when have we seen this before?). Think about it — if productivity increased 100%, your savings would buy — ceteris paribus — more or less double what they buy today.

We've already seen this exact same thing happen in countries like Venezuela and Argentina — HODLers managed to protect their purchasing power as their nations' currencies crumbled. Imagine this happening worldwide, and you get to understand the magnitude of this economic order change. The value of your money — Bitcoin — would be, for the first time in a long time, maybe ever, truly tethered to the increases of productivity of the whole world. It would mean the absolute reversal of what happened in 1971... slowly, then suddenly.

This phenomenon will, of course, render many modern "bullshit" economic activities completely unprofitable, vis a vis just HODLing — not that this is novel or anything, as I think pretty much every HODLer already knew this. Why would you invest in a business that gives you 3% returns with non-negligible risk, when just sitting on your money will give you an automatic 3% increase in purchasing power? Obviously you'd keep saving...

...and all you have to do, to bring about this just economic order, where the wealth you earned stays earned, in which people keep the real value of what they work for, is keep saving.

HODL.